- Market Research

- Stocks Research

- ETF Research

- Mutual Funds Research

- Options Research

- Bonds & Fixed Income Research

Market Research

U.S. and International Market Research

Get market news, international research coverage and commentary.

Get the most comprehensive macro economic research available.

Find out about our Industry leading research providers.

The example above is hypothetical and provided for illustrative purposes only. It is not intended to represent a specific investment product. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. Each investor needs to review an investment for his or her own particular situation before making any investment decisions.

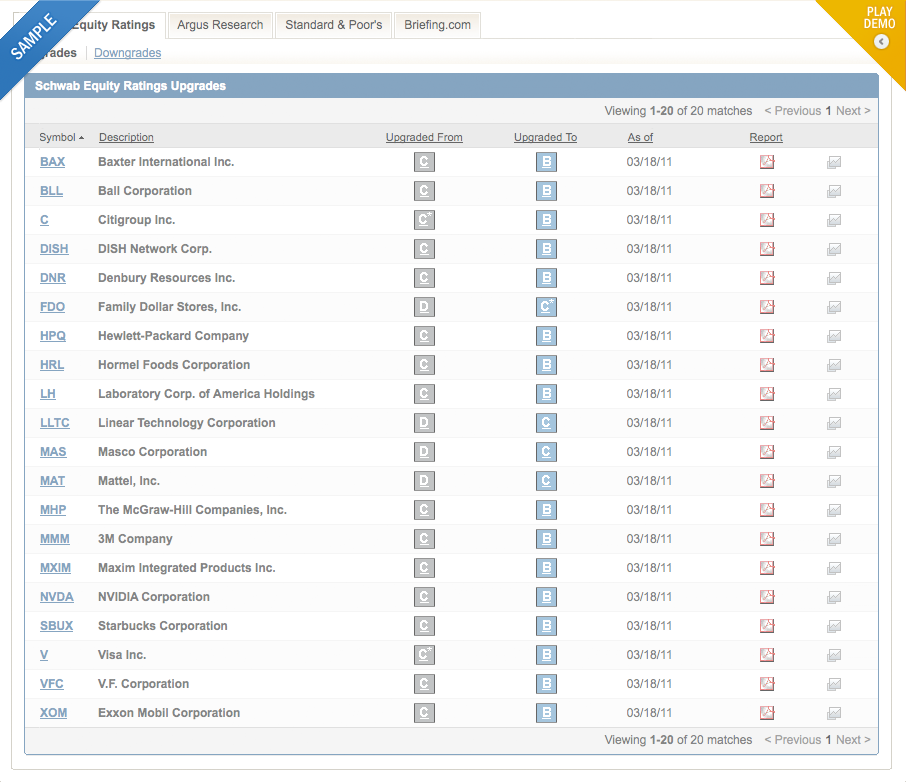

Schwab rates stocks using a scale of A/B/C/D/F. Schwab’s outlook is that "A" rated stocks, on average, will strongly outperform and "F" rated stocks, on average, will strongly underperform the equities market over the next 12 months. Schwab Equity Ratings are based upon a disciplined approach, systematic, approach that evaluates each stock on the basis of a wide variety of investment criteria from four broad categories: Fundamentals, Valuation, Momentum, and Risk. This approach attempts to gauge investor expectations since stock prices tend to move in the same direction as changes in investor expectations. Stocks with low and potentially improving investor expectations tend to receive the best Schwab Equity Ratings ("A" or "B" ratings), while stocks with high and potentially falling investor expectations tend to receive the worst Schwab Equity Ratings ("D" or "F" ratings). From time to time, Schwab may update the Schwab Equity Ratings methodology. The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.